Mar 05, 2018 - Keep Recent Market Volatility in Perspective

Written by: Joseph Piela, CFP®, Portfolio Advisor with Sax Wealth Advisors

After a period of relative calm in the markets, the recent increase in volatility in the stock market has resulted in renewed anxiety for many investors. Amid ominous headlines and references to more severe market downturns in prior years, we think it is important for investors to remember some key facts about the U.S. equity market to avoid making hasty, emotional decisions:

Drawdowns are common – Since 1979 the average intra-year decline in the S&P 500 was nearly 14%. About half of the years observed had declines of more than 10%, and around a third had declines of more than 15%. However, despite these drawdowns, calendar year returns were positive in 32 out of the 37 years. In other words, though market declines are common, patience has historically rewarded investors who stay the course.

Long-term equity returns historically have been positive – While it can be easy to become emotionally swept up in the day-to-day movements of the market, equities have historically been a critical component for investors to reach their long-term growth objectives.

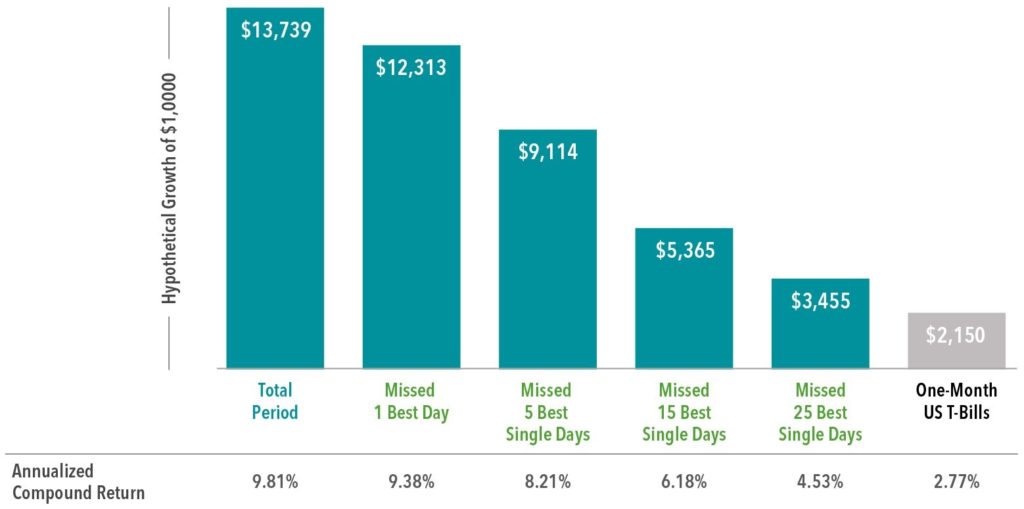

Market timing is a risky endeavor – Since investors are unlikely to be able to identify in advance which days will have strong returns and which will not, the prudent course is likely to remain invested during periods of volatility than jump in and out of stocks. Otherwise, an investor runs the risk of being on the sidelines when returns happen to be strongly positive. The data shows that missing only a few of the best single days in the market would have resulted in substantially lower returns than the total period had to offer. The chart below helps illustrate this point.

While market volatility can be nerve-racking for investors, reacting emotionally and changing long-term investment strategies in response to short-term declines could prove more harmful than helpful. By adhering to a well thought-out investment plan, ideally agreed upon in advance of periods of volatility, investors may be better able to remain calm during periods of short-term uncertainty.

Do you have questions about your portfolio’s resilience in tumultuous financial times? Feel free to reach out to your Sax Wealth Advisor for more information or guidance.