January Market Review from CIO, Les Vasvari

Dear Clients,

2026 opened with a robust, broad-based rally that defied a backdrop of persistent macro uncertainty. Building on the momentum of late last year, January’s performance featured a welcome expansion in market breadth; value-oriented and economically sensitive areas stepped into the lead, not just in the U.S. but to the Emerging Markets and International Developed regions as well. While political headlines, ranging from the military intervention in Venezuela to the nomination of a new Fed Chair captured the news cycle, the markets remained anchored by stable financial conditions and robust corporate fundamentals.

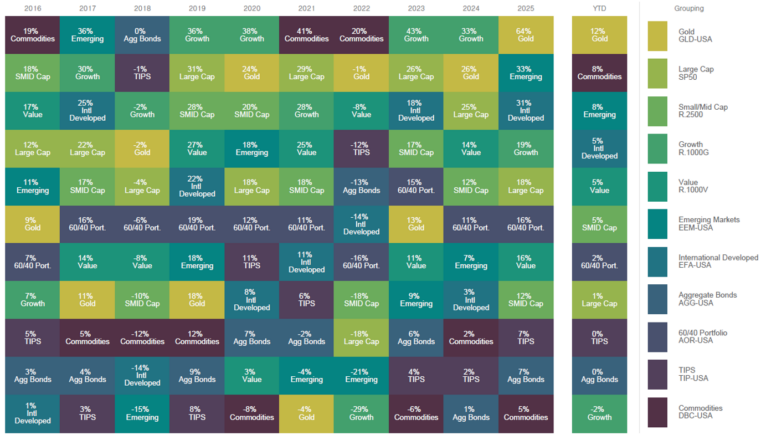

The asset class performance “quilt” included below highlights returns across a range of asset classes over the past 10 years. While leadership shifts meaningfully from year to year, the quilt illustrates how diversified portfolios have historically helped smooth returns over full market cycles.

Source: FactSet, as of January 31, 2026

Market Highlights from January, 2026

- Gold Volatility: Gold was the top-performing asset in January but its rally faced a sharp uptick in volatility. It was down 10% on the final day of the month, the worst day it’s had in 46 years.

- International Strength: International equities continued to outpace domestic markets, supported by a weakening U.S. Dollar and improving global fundamentals.

- Value & SMID Leadership: Value and Small/Mid-cap equities outperformed as investors grew more confident in the durability of economic growth.

- Growth/Tech Lags: Mega-cap Technology took a backseat to the broader market as investors rotated away from 2025’s top performers.

The “Warsh Effect” and Institutional Trust

A pivotal driver of recent sentiment has been the nomination of Kevin Warsh as the next Fed Chair. The market narrative is already shifting toward a more “traditional” and stable outlook. We have been monitoring precious metals closely; the significant rally in gold and silver over the past year signaled a wavering trust in institutional stability. Therefore, the sharp dip in these metals following the nomination is actually a constructive sign; it suggests the market views Warsh as a credible, stabilizing pick for the future of the dollar.

Navigating Historical Patterns

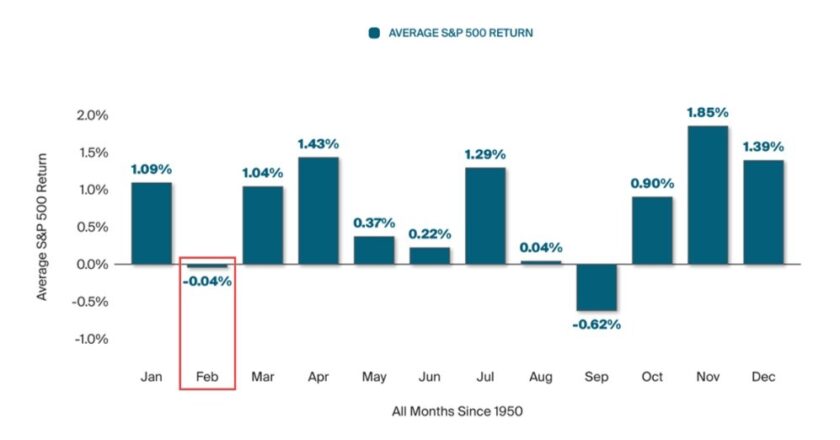

While this is a positive step for confidence, there may be some “bumps in the road” ahead. February is typically the second-weakest month of the year, often serving as a period of consolidation. We are also in a midterm election year, which historically invites higher volatility as policy debates heat up. February’s typical weakness is often just the pause that refreshes before two months (March and April) that are seasonally quite strong.

Source: © Exhibit A, FactSet Research Systems Inc., Standard & Poor’s.

Definitions & Methodology: The chart shows the S&P 500’s average price return in every month since 1950. It illustrates the seasonal pattern the S&P 500 has exhibited historically.

Furthermore, markets tend to “test” new Fed leadership. While Jerome Powell’s term does not end until May, the transition period can be sensitive. Investors may “feel out” how the nominee reacts to shifting economic data during the confirmation process and beyond.

The January Barometer: A Silver Lining

On the other hand, these potential seasonal headwinds are offset by the “January Barometer”: historically, years that begin with a positive January, as 2026 just did (+1.4% for the S&P 500), tend to lead to strong full-year returns. In fact, when January is positive, the rest of the year has historically been positive about 87% of the time*.

* Source: Carson Investment Research, FactSet

The Macro Foundation: Resilient and Constructive

From a macro perspective, the “weight of the evidence” remains decidedly favorable, supported by easing inflation, steady labor conditions, and ample liquidity that has allowed risk assets to absorb geopolitical noise without disruption. We view the current market action as healthy consolidation, a productive “digestion” of recent gains that serves as a potential springboard for the next leg of this bull market’s advance. While seasonal shifts or the transition in Fed leadership may invite near-term volatility, the underlying foundation remains robust across diverse styles and sectors. We view any such pullbacks as strategic opportunities within a clearly constructive long-term trend, and we remain focused on the durability of corporate earnings as we lean into the strength of this broadening global market.

Les Vasvari, CFA, CMT

Chief Investment Officer

SAX Wealth Advisors

*Source: Carson Investment Research, FactSet

Disclosure: This material is provided by Sax Wealth Advisers, LLC, an SEC-registered investment adviser, for informational and educational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any security. The views and opinions expressed are those of the author as of the date of publication and are subject to change without notice.

Past performance is not indicative of future results. Market conditions, economic factors, and investment outcomes are inherently uncertain, and no investment strategy can guarantee profit or protect against loss. This commentary may include references to historical data, seasonal patterns, or market trends, which are not predictive of future performance.

This communication is intended for a broad audience and does not take into account the individual financial circumstances, objectives, or risk tolerance of any specific investor. Investors should consult with a qualified financial professional before making investment decisions.

Certain information contained herein has been obtained from third-party sources believed to be reliable; however, Sax Wealth Advisers, LLC, does not guarantee its accuracy or completeness.