Meet Our New CIO, Les Vasvari as He Shares His Investment Philosophy

Dear Clients and Friends,

I am writing to you today with great enthusiasm to wish you a happy New Year and to introduce myself as SAX Wealth Advisors’ first Chief Investment Officer (CIO). It is a privilege to take on this responsibility, and I am deeply committed to the trust you have placed in our firm.

My objective as CIO is to oversee our investment strategy and portfolio management, strengthening our commitment to delivering exceptional outcomes. My philosophy is rooted in appreciating that your assets are precious, they represent your hard work, legacy, and future aspirations.

I will direct our investment decisions by weighing dynamic economic conditions against market history. I am fortunate to lead a phenomenal investment team. Together, we navigate an unpredictable market using a rigorous combination of fundamental, quantitative, and technical analyses to help inform disciplined investment decisions aligned with your financial goals. My background as a client-facing portfolio manager for ultra-high net worth clients and my experience at a quantitative research firm has uniquely prepared me for this holistic approach.

I want to assure you that your advisor will remain your primary contact with our firm, and I will serve as a resource for them to lean on, more than anything. We believe that sound financial planning will always be more critical than investment management, and our success is dependent on first understanding your specific financial needs and goals. Please feel free to reach out to me at LVasvari@SAXWA.com if you have any questions or want to get to know me better.

On a personal note, when I’m not analyzing markets, I am usually chasing after my young son, Theo. My wife, Laura, and I currently live in Long Island City, Queens, though we are eyeing a move to New Jersey next year. I am a big foodie who loves to cook and I’m excited for what’s shaping up to be a fun ski season (on the East coast, at least).

A Humble Approach to Complex Markets

My approach begins with a core, guiding principle: humility. Only a handful of people in the world can consistently preempt market moves, and I hate to break it to you, but I don’t think I’m one of them. Instead, I lean heavily on understanding trends, viewing the markets as highly efficient mechanisms that discount knowable information extremely well.

To explain this, I often look to the concept of the “Wisdom of the Crowds.”

There is a classic experiment involving a country fair and a competition to guess the weight of a cow. Everyone at the fair has a different background – butchers, farmers, laypeople – leading each individual guess to be an over or underestimation based on their personal biases. However, when you take the average of all those guesses, the result comes remarkably close to the actual weight of the cow.

I once tested this theory with a group of middle schoolers I was introducing to investing. I presented them with a jar of candy and asked them to guess the count. Individually, the guesses were all over the map. But the average? It was spot-on.

Image generated by Gemini, Google, December 2, 2025.

Why Price Leads Fundamentals

Public markets work similarly. Millions of people and institutions place trades based on everything from deep research to social media posts. Individually, these views are flawed, but every trade acts as a vote on value. In aggregate, the market is incredibly good at discounting all knowable information, certainly better than we could do as a team.

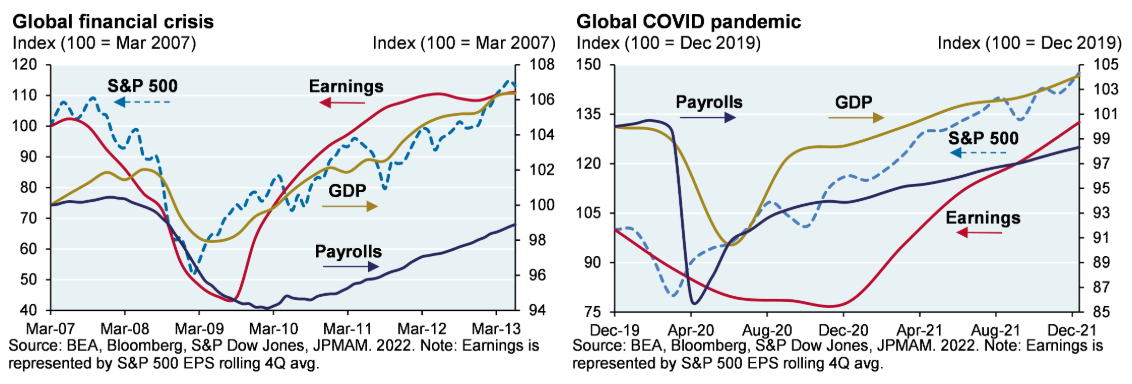

Because the market is an aggregation of future expectations, we pay close attention to price action. Price tends to lead fundamentals (such as earnings, GDP, and employment data), acting as a signal for what the “crowd” sees coming before it shows up in the data. As the chart below shows, during both the Global Financial Crisis and the COVID-19 Pandemic, the S&P 500 bottomed and began to rally well before earnings, GDP, or payrolls recovered. The market anticipates the turn; it does not wait for the “all-clear” signal from economic data.

Context Matters

This is not to say I disregard industry dynamics and economic data. All data is critical, but it is vital to understand what is important and when.

A prime example of why you need to keep abreast of changes outside of price movements occurred at the beginning of this month. The Federal Reserve’s “Quantitative Tightening” (QT) policy officially lapsed on December 1st, 2025.

By way of background, Quantitative Tightening (QT) entailed the Federal Reserve allowing bonds to mature without rolling the proceeds into new bonds, effectively draining market liquidity. The end of QT implies the Fed will cease this runoff and return to being a buyer of treasuries. This policy shift is a form of easing; having a massive buyer return to the market should support bond prices and thus potentially lead to naturally lower interest rates.

History gives us a clue as to what this might mean. The last time QT ended (August 1, 2019), the S&P 500 rallied approximately 10%, and 10-year interest rates declined slightly (~-0.3%) in the five months that followed, a trend that held until the onset of COVID-19 turned the global economy upside down.

Looking Ahead

If I could distill my investment philosophy into a single concept, it is that portfolios should be positioned to be on the right side of long-term trends. At the very least, they shouldn’t be on the wrong side of these trends.

Just like crafting a great meal, successful investing requires patience, discipline, adaptability, and the right mix of ingredients because trends, like flavors, take time to develop. I look forward to digging deeper into these trends in future letters. Until then, I wish you and your families a very happy New Year. I’m honored to be on this journey with you.

Sincerely,

Chief Investment Officer

SAX Wealth Advisors

Disclosures: Investments in securities entail risk and are not suitable for all investors. This is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

This document contains forward-looking statements relating to the opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by such words as; “might,” “anticipate(s)”,” planned”, and other similar terms. Examples of forward-looking statements include success or lack of success of any particular investment strategy, or market indicator. All are subject to various factors, includingeconomic conditions, changing levels of competition within markets, changes in interest rates, changes in legislation or regulation, and other technological factors affecting a portfolio that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve known and unknown risks. Accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SAX Wealth Advisors or any of its affiliates or principals nor any other individual assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.