Jun 18, 2021 - Planning NOW for the Estate Tax Overhaul

The tax world may likely change very soon and in a dramatic way as substantial structural changes are in the works. The recently proposed “For the 99.5% Act” would bring sweeping changes to the taxation of estates and inherited gains, while the “Sensible Taxation and Equity Promotion” (STEP) Act would eliminate the step-up in basis that inherited assets currently enjoy.

This creates a time sensitive planning opportunity as proposed changes would immediately become the costliest in generations if enacted and are so expansive in reach that they may adversely affect millions of families. Taxpayers will need to act NOW or risk losing the closing window of time to take advantage of significant planning opportunities under current law.

This article is intended to help you identify some issues and items to discuss with your team of advisors to determine what moves might be worth making. There is a good chance you might benefit tremendously from taking significant action now before it is too late.

Background

To understand where we are going with estate and gift taxes, it’s important to understand where we currently are. The 2021 exemption, under current law, is $11.7 million per U.S. taxpayer. That’s $23.4 million per married couple.

The exemption is the aggregate amount that can be given away during your lifetime. Under current law, the exemption that currently exists is going to be automatically reduced in 2026.

However, Congress is signaling an interest in reducing the exemption and raising taxes now, which is why this topic is so important today. We believe that 2021 could be a last chance planning opportunity.

Here are some changes the new plans would bring about:

“For the 99.5%” Act

- The estate tax exemption would be reduced from its current $11.7 million to a meager $3.5 million. That means you would only have up to $3.5 million to give away at your death.

- Lifetime gifting would be limited to $1 million, which could be critical for asset protection planning, not just estate tax.

- The tax rate would be increased. Currently, it’s a flat 40%. We could see a change to a graduated tax scale from 45% up to 65% for those with estates higher than $1 billion.

- Valuation discounts in most situations would be eliminated.

- Technical changes would reduce efficacy of planning techniques like grantor trusts and GRATs. These technical and structural changes are more problematic than the exemption changes and tax rate changes. We believe these are going to really rock the foundation of traditional estate planning.

- Tax changes on assets in trust after 50 years are going to require special action by taxpayers. This is in direct contrast to current law that may permit trusts to continue forever without ever being subject to transfer tax.

- “Portability” is retained, which is the ability of the surviving spouse to safeguard the first to die spouse’ exemption.

Deemed Realization Proposals: Biden plan, STEP Act & “Pascrell” Bill

- Transfers by gift upon death – treated as sold for income tax purposes and transferor will recognize gain.

- Only the first $100,000 or $1 million (depending on plan enacted) of unrealized capital gains would be exempt.

- Legislation is expected to allow taxpayers to pay the income tax that’s going to be due on these capital gains in installments over 7 or 15 years (depending on plan enacted) to the extent the tax applies to illiquid assets.

- Deduction against estate taxes for any capital gains tax.

- STEP Act is retroactive to transfers after 12/31/20; Pascrell Bill effective for transfers after 12/31/21.

New proposed tax rate structure:

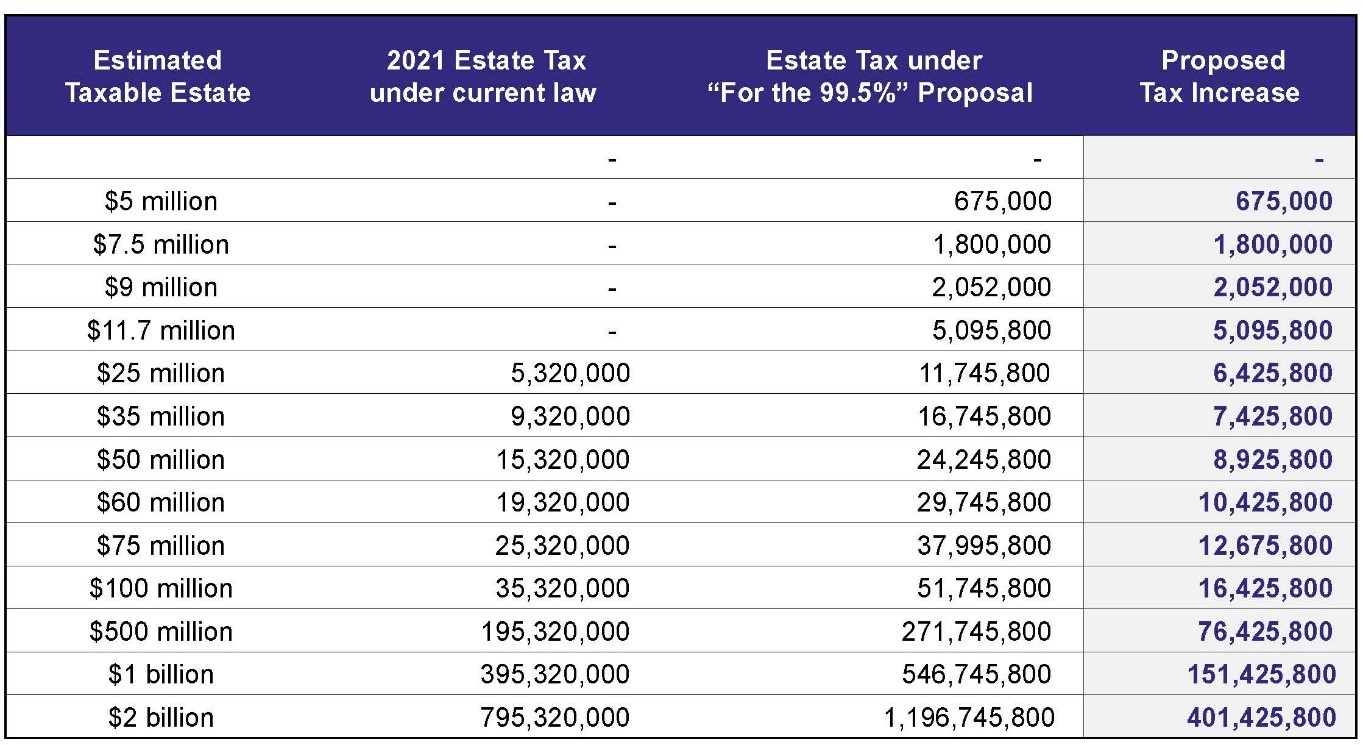

In Example A, you can see the “For the 99.5%” Act’s proposed tax rate structure and how it’s going to affect taxed revenue.

You’ll also note that this is just the estate tax. In addition to that, there is a possible capital gains tax on debt. So, for example, on an $11.7 million estate, tax could be substantially more than the $5 million shown on the table illustrated.

Example A

Preemptive Planning Paramount!

Fortunately, the current draft of the “For the 99.5%” Act is not retroactive, but there are provisions of the “Sensible Taxation and Equity Promotion” (the “STEP”) Act that will be retroactive to January 1, 2020, so you need to watch your STEP!

Effective date of the “For the 99.5%” Act could be as early as July or as late as October, which means plan NOW and complete planning as soon as possible, but with the consideration to the STEP retroactive date.

Advantages of planning now include:

- “For the 99.5%” Act suggests that grantor trusts that are established before enactment may be grandfathered.

- Valuation discounts should be available until any new laws are enacted.

- The time before enactment may be a last chance opportunity to lock in current exemptions by using grantor trusts without entirely giving up access.

- Note: No basis step up on assets in trust – if STEP Act becomes law, basis step up on death will not be available.

- Remember, moving assets to a trust can protect from suits and claims, elder financial abuse, and your kids divorce, so there may be multiple, even non-tax reasons to act.

Valuation discounts will be largely restricted after enactment.

To understand what a valuation discount is, it’s important to start with the definition of fair market value. Fair market value is defined as “the price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.”

What does that mean? Generally, giving away a fractional interest would allow the transferor to take discounts to account for the inability to sell or exercise any control over interests – owning ¼ of an asset is not the same as owning 25% of the gross value of the asset. Both the “For the 99.5%” Act and the Biden administration proposals would disallow any discounts on “nonbusiness assets” based on the lack of marketability or lack of control.

For an advisor point of view, this Act is honing in on some of the most powerful planning tools we have used for decades. This Act is a well-crafted plan in terms of restricting valuation discounts.

Proposed Valuation rule changes being considered:

- Non-business assets of an entity are valued as if the asset was transferred directly.

- Non-business assets are those assets which are not used in the active conduct of a trade or business.

- Passive assets are those which are not used in the active conduct of a trade or business.

- No discounts allowed if the transferee and family members have control or majority ownership.

GRAT Attack!

Grantor Retained Annuity Trusts (GRATs) are a technique sanctioned by the tax regulations that let a taxpayer shift, with limited risk, upside appreciation on assets put into the GRAT out of your estate. That opportunity may soon end. So, GRAT it while you can (but watch your STEP)!

Here are some of the proposed changes specific to GRATs:

- Minimum 10-year term

- Maximum term of the life expectancy of the annuitant plus 10 years

- Remainder interest in the GRAT (the gift amount) must be equal to the greater of:

- 25% of the trust’s fair market value of the asset you are transferring

- $500,000

If the “For the 99.5%” Act becomes law, each U.S. taxpayer would be limited to a $1 million gift tax exemption. GRATs are going to become far less effective if these provisions are enacted.

Impacts to Grantor Trusts

Another way that these proposals create real structural changes to planning is how it affects Grantor Trusts. Under current law, Grantor Trusts are advantageous. They are disregarded for income tax purposes, allowing assets in the trust to grow, while the grantor reduces their taxable estate by the value of the income taxes paid on the income earned by the assets in the trust. The grantor can borrow from and lend to the trust without income tax consequences and the grantor can substitute assets in the trust, whether by purchasing the assets using a Note or by swapping other assets of equivalent value. The flexibility of grantor trusts allows a grantor to freeze the value of the grantor’s taxable estate while allowing assets in the trust to appreciate.

The proposed legislation would dramatically alter the benefits of grantor trusts:

- Value of assets transferred to a grantor trust after enactment of the proposed law would be included in the grantor’s taxable estate less any taxable gifts made to the trust.

- Distributions from a grantor trust during the life of the deemed owner would be taxable gifts, less any amount already treated as a taxable gift.

- Under STEP and the Biden proposal, transfers from a grantor trust to a beneficiary would be treated as a deemed sale and assessed a capital gains tax.

- Existing grantor trusts appear to be “grandfathered” to the extent that they are already funded.

Changes to Dynasty Trusts

The “For the 99.5%” Act also has some interesting changes coming down the pike for dynastic trusts. The inclusion ratio of any trust other than qualifying trust must be 1, which would mean that for any transfers made out of the trust it would be to someone who is a skip person. A skip person is a grandchild or subsequent generation.

The qualifying trust must terminate not more than 50 years after the trust is created, and pre-existing trusts must terminate within 50 years of enactment.

The STEP, Pascrell bill and Biden proposal would assess a capital gains tax on assets held in trusts as though the assets were sold. Depending upon which proposal, these deemed sales events would occur every 21 years (STEP), every 30 years (Pascrell) or every 90 years (Biden).

This will have a huge impact to dynasty planning. It is important to understand that you can’t work around this if you have a trust from 20 years ago – it’s affected. Each proposal, if enacted, would apply a deemed sale upon trusts already in existence or created after enactment.

Annual Exclusion Gifts

You may be using annual exclusion gifts to fund life insurance policies held in trust. Currently, the annual exclusion for gifts is $15,000 per person. Under the proposed legislation, gifts to trust would be capped at two times the annual exclusion in the aggregate, without indexing for inflation, meaning you would only be able to put about $20,000 into any insurance trust without triggering a gift tax.

The proposal does not appear to affect contributions to qualified tuition programs (529 plans).

For those with life insurance or other plans funded with annual gifts, you should consider shifting value to those trusts that can be used to pay premiums on life insurance policies or prepay premiums, before enactment of these restrictions.

The Right Advisors

It has been said that it takes a village to raise a child. Similarly, it takes a robust team of trusted advisors to construct a meaningful estate plan. Before making any decision or taking any action, you should consult professional advisors who have been provided with all pertinent facts relevant to your particular situation. We are dealing with an uncertain, changing tax environment that could impact you in big ways, and it is important that you have a CPA, planning attorney, valuation professional (if applicable), wealth advisor, insurance consultant and corporate or real estate counsel (if you’re transferring business or real estate interests), in order to ensure that your planning strategies are thoughtful and strategic, based on your short and long term goals. It is vital that your advisory team has in-depth knowledge of the changes that are coming down the pike and how they may impact you specifically.

In Conclusion

The future is unknown. The ambitious spending plans in Congress arising from significant pandemic losses have really crunched the federal budget and exploded the deficit, making tax increases and significant tax reform much more likely. It is critical that you prepare for the worst and hope for the best. By planning carefully and creatively now, you could take advantage of massive opportunities that may no longer be available come 2022. Act now, but act with caution.

About the Author

JOY MATAK, JD, LLM is a Partner at Sax and Co-Leader of the firm’s Trust and Estate Practice. She has more than 20 years of diversified experience as a wealth transfer strategist with an extensive background in recommending and implementing advantageous tax strategies for multi-generational wealth families, owners of closely-held businesses, and high-net-worth individuals including complex trust and estate planning. She can be reached at jmatak@saxllp.com.